Stocks sink with bond yields as Trump fuels growth fears

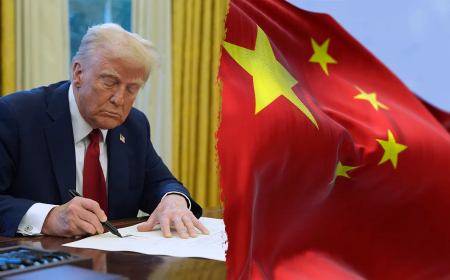

NEW YORK/LONDON (Reuters) -Global stocks slumped more than 2% after earlier touching a near two-month low on Monday while U.S. bond yields dropped as investors worried about an economic slowdown after U.S. President Donald Trump did not rule out his tariffs causing a recession.

Wall Street indexes extended losses gradually as the session wore on. But investors had started seeking safety as early as Sunday when Trump in a Fox News interview talked about a "period of transition" while declining to predict whether his tariffs on China, Canada and Mexico would result in a U.S. recession.

Market strategists pointed to the comments as a key reason for Monday’s cautious mood among investors.

"The Trump administration seems a little more accepting of the idea that they’re OK with the market falling, and they’re potentially even OK with a recession in order to exact their broader goals," said Ross Mayfield, investment strategist at Baird in Louisville, Kentucky.

"I think that’s a big wake-up call for Wall Street. There had been a sense that President Trump kind of measured his success on stock market performance. There was even somewhat of a "Trump put" so to speak. And I think we’re seeing that’s not the case, so the market is starting to reflect that reality."

On Wall Street at 2:55 p.m., the S&P 500 fell 185.25 points, or 3.22%, to 5,584.33 and the Nasdaq Composite fell 833.24 points, or 4.58%, to 17,362.99 with both on track for their biggest one-day percentage losses since September 2022.

The Dow Jones Industrial Average fell 1,052.26 points, or 2.46%, to 41,748.50

MSCI’s gauge of stocks across the globe fell 22.68 points, or 2.66%, to 829.42, eying its biggest one-day drop since August 2024. Earlier, the pan-European STOXX 600 index closed down 1.29%.

Yields fell with U.S. government bonds in demand after the Trump interview cut into investor confidence.

“If the occupant in the White House is himself not terribly optimistic about short-term growth expectations, why should the market be optimistic about it?” said Will Compernolle, macro strategist at FHN Financial.

Heading for its biggest one-day drop in almost a month, the yield on benchmark U.S. 10-year notes fell 9.7 basis points to 4.221%, from 4.318% late on Friday.

The 30-year bond yield fell 7.4 basis points to 4.5432% while the 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 10 basis points to 3.902%.

In currencies, investors looked for safety. Against the Japanese yen, the dollar weakened 0.5% to 147.29.

However, the euro was down 0.05% at $1.0827 and Sterling weakened 0.41% to $1.2868.

Oil prices sank as tariff uncertainty kept investors on edge along with rising output from OPEC+ producers, although potential sanctions on Iranian oil exports limited losses.

U.S. crude settled down 1.51% or $1.01 at $66.03 a barrel while Brent settled at $69.28 per barrel, down $1.08 or 1.53%.

Gold prices fell as profit-taking countered support from safe-haven demand fueled by geopolitical uncertainty, with focus also on the U.S. inflation data later this week.

Spot gold fell 0.89% to $2,884.97 an ounce. U.S. gold futures fell 0.84% to $2,880.20 an ounce. Copper declined 1.14% to $9,504.00 a tonne.

In cryptocurrencies, bitcoin fell 6.44% to $77,734.00. Ethereum declined 9.68% to $1,849.88.

(Source:Investing)